China aims to more than double its consumption of natural gas in the next several years and that has potential impacts for B.C., including Squamish and Woodfibre LNG Limited.

Liquefied natural gas (LNG) is created by cooling natural gas to -162°C, which decreases the volume of the gas by 600 times, allowing for easier storage and transportation. The economic potential created by LNG formed a central plank in the B.C. Liberals' 2013 election platform, contributing to the party's surprise reelection. Since then, there has been little progress in creating the multi-billion dollar infrastructure required to advance the industry.

But an online panel discussion last week, as well as comments by a local author and expert in the field, give some insights into what China's energy policy might mean for B.C.'s LNG sector in the years to come.

The Dec. 5 panel was convened by the Pembina Institute, a research and consulting body that aims to reduce the negative impacts of fossil fuels while supporting the transition to a clean energy system.

At present, coal accounts for two-thirds of China's energy supply, with oil accounting for 20 per cent and natural gas six percent. But the carbon dioxide-produced air pollution crisis, due in large part to coal use, is driving new thinking among Chinese policy-makers, said panelist Jiang Lin, who is the Nat Simons chair in China energy policy at Lawrence Berkeley National Laboratory, which is associated with the University of California.

The Chinese government has initiated a range of new approaches to reduce coal dependency, including increasing the six percent LNG share of energy to 15 per cent within the next couple of years. They are also investing intensively in solar and wind energy and are the world's largest producers of electric vehicles, according to the other panelist, Ranping Song, developing country climate manager for the World Resources Institute, a Washington, D.C.-based agency that promotes environmental sustainability, economic opportunity, and human health and well-being.

"Clearly, the share of natural gas will increase quite a bit in the near- to medium-term," said Lin. "As we talk about air pollution, switching away from coal to natural gas is an obvious solution in the intermediate term."

But, he added, transportation costs make natural gas three to four times higher in China than it is in the U.S. or Canada.

That's not the only challenge, said Robert Falls, who grew up around Howe Sound, and is an adjunct professor at UBC and author of the recently released book Carbon Play, about Falls' decades in the industry. In addition to working in Canada's natural gas sector, he has also worked for Shell China on a major carbon reduction project.

In an interview with The Chief, Falls said he believes that the Chinese government is sincere in recognizing the need to reduce emissions and improve the climate.

But a doubling of Chinese natural gas consumption does not guarantee boom times for B.C.'s LNG industry.

"There are so many things that people don't realize," said Falls. "There are competitors out there that are supplying natural gas. We are not the only guys. There is price competition and security of supply competition. So B.C.'s up against quite a few external factors we have no control over. And then, of course, [there are] internal factors relating to the general sensitivity around developing pipelines and gas plant facilities."

Falls calls natural gas a "transition fuel" because it produces fewer emissions than coal or oil.

"It is the least carbonaceous of the fossil fuels and it's got all kinds of attributes that go along with that," he said. "So the market internationally has been growing for natural gas. British Columbia could supply part of that market, but there is a whole process to go through and it's very expensive."

Getting the LNG export market off the ground is not for the faint of heart, he warns.

"These are big projects, they're very expensive and there are lots of hurdles to jump through," he said. "There are risks to the investors, the companies, in terms of the changing political fabric of the province."

While the natural gas industry has what Falls calls "a very, very, very good record" on safe transportation, he adds, "But a 747 can fall out of the sky and drop on your house, anything can happen."

He acknowledges those who want no more heavy industry in Howe Sound – about which his new book includes a full chapter – but he sees LNG as among the more benign industries.

"The kinds of impacts that would come from Woodfibre LNG are more along the lines of perhaps aesthetics, where you would see ships go up and down, although it's not that many ships, and also whatever risks there are associated with navigation and such," said Falls, adding that risk is not his area of expertise.

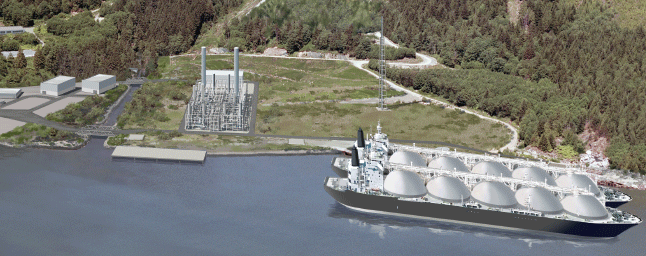

Woodfibre LNG limited opted not to offer specific comment for this article. However, the company has announced this month that it is proceeding with geotechnical and geophysical survey work that will provide further information on the surface and sub-surface conditions of the site and the foreshore. The company has also hired KBR Inc., which has operations in Houston, Tex., and Edmonton, to undertake “pre-notice to proceed” services, which will include cost optimization and development of a proposal for an engineering, procurement and construction contract. The company hopes to begin engineering, procurement and construction in 2018.