The experience of a woman seriously injured in a scooter crash in Thailand is a reminder to travellers to do their research before purchasing travel medical insurance, say travel experts.

Danielle Kliaman broke all the bones in her foot when she was hit by a truck while riding a scooter on the island of Ko Samui, Thailand, last week.

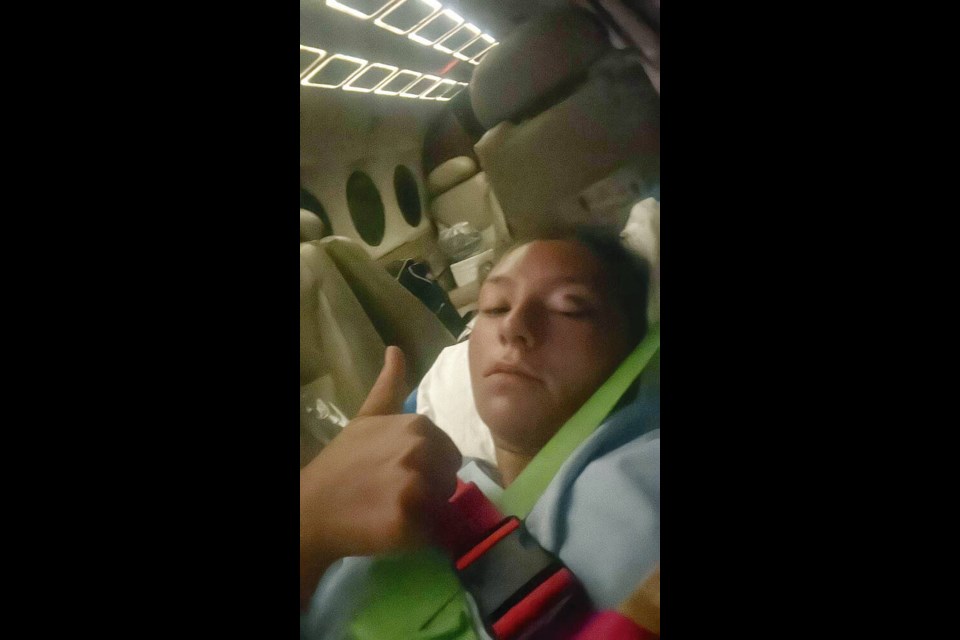

After her foot became infected, her family paid $30,000 for an air ambulance to fly her to a hospital in Bangkok.

But the family has had difficulty getting her travel medical insurance company to pay for her transport and medical care. Kliaman’s mother, Annette, had to pledge that she would cover her daughter’s hospital bill in case the insurance company did not pay.

Kliaman had purchased her insurance, with a $250,000 US limit, from a U.S.-based company. The family has requested that the name of the company be withheld due to ongoing discussions over reimbursement for bills already incurred and future expenses.

The Times Colonist attempted to contact the company, but had not received a response by publication deadline.

Travel experts say it’s important to check the maximum amount of coverage for medical expenses before you buy travel medical insurance.

Most people in the travel industry contacted by the Times Colonist were surprised to hear of the $250,000 US limit on Kliaman’s policy, which they consider too low. They said Canadian travel-insurance policies typically come with $5 million to 10 million in medical coverage.

“Medical costs can easily reach $10,000 a day,” said Will McAleer, executive director of Travel Health Insurance Association of Canada, an umbrella group that represents 90 per cent of the industry in Canada.

“If you have a code-blue event in a U.S. hospital, it can be as high as $10,000 an hour.”

He said travellers choosing between different insurance policies should look for ones tailor-made for Canadians.

“Plans underwritten by travel agents and insurance brokers in Canada take into account Canadian needs and expectations when it comes to medical care. They have the knowledge and experience to properly explain policies to clients so that they understand the differences between different plans,” said McAleer, who is based in Toronto.

Insurance premiums are based on the length of the trip, the age of the traveller, where they are travelling and pre-existing medical conditions.

Most plans originating in Canada take into account the traveller’s provincial medical plan. While the B.C. Medical Services Plan provides some coverage — $75 a day — for emergency hospital care for travel outside Canada, it’s clearly not enough to cover physician and hospital care, prescriptions, ambulance services, and travel back home.

Cathy Scott, CEO of Departures Travel, the oldest independent travel agency in Victoria, said travel insurance sounds expensive — until you need it. “It’s not worth going cheap,” she said. “Travel is supposed to be joyful.”

She said that in the case of a medical emergency, the company she uses — Manulife — has Canadian doctors taking telephone calls, guidance on next steps and payment up-front for medical expenses.

Companies will typically pay first and investigate later, experts said.

Scott said she has seen a “huge” uptick in people purchasing travel insurance, which includes trip-interruption insurance, since the COVID-19 pandemic.

“The people who didn’t get insurance, got nothing. Those who purchased insurance at least got something back,” she said.

When an emergency does happen, insurance companies have in-house personnel or contracted companies that provide assistance services, liaising with doctors and hospitals, the policy holder and the insurance company.

They look over doctors’ reports, police reports and other documents, advise insurance companies of the steps necessary to get aid to the individual and ensure payment of local providers.

On Thursday, Kliaman’s family learned her insurance company will cover the cost of surgery to her foot, but won’t reimburse the family for the air ambulance trip.

McAleer said determining whether a medical evacuation is necessary rests with medical personnel — if the doctor in charge decided the patient did not need immediate air evacuation — or that an alternate mode of transport was available — the company is within its rights to deny that portion of the claim.

McAleer suggests the family keep lines of communication open as well as retaining all records.

David Rose, general manager of Mile 0 Tours, said he is sympathetic to the family’s plight. He said during a medical emergency, “everything seems to take longer than it should.”

All the experts agree that consumers should read the fine print when comparing policies and ask for help picking the best policy for their needs.

“No one [in the travel insurance industry] wants to see what this family is going through. It’s inconsistent with the standards we have set for the industry,” said McAleer.