As the province looks to increase supply in 2023 to meet housing and immigration targets, there are industry concerns that construction costs, high interest rates and government programs that no longer accommodate the current market are making purpose-built rentals next to impossible to move forward with, according to Brad Jones, senior vice-president of Wesgroup Properties.

Prior to six months ago, rental projects saw a boom as a result of low interest rates and government programs, like the CMHC Rental Construction Financing Initiative (RCFi), that provided many incentives, said Jones.

“That's really changed. The prospects of doing rental now are incredibly difficult as a result of some of those incentive programs changing, as well as the increase in interest rates,” he said.

Jones noted increasing numbers of applications and competition among developers as one of the driving factors of the RCFi becoming less desirable.

“What we're really facing now, and starting to really see going into next year, is a fairly significant increase in government fees and charges for amenity delivery, infrastructure, servicing, etc,” he said.

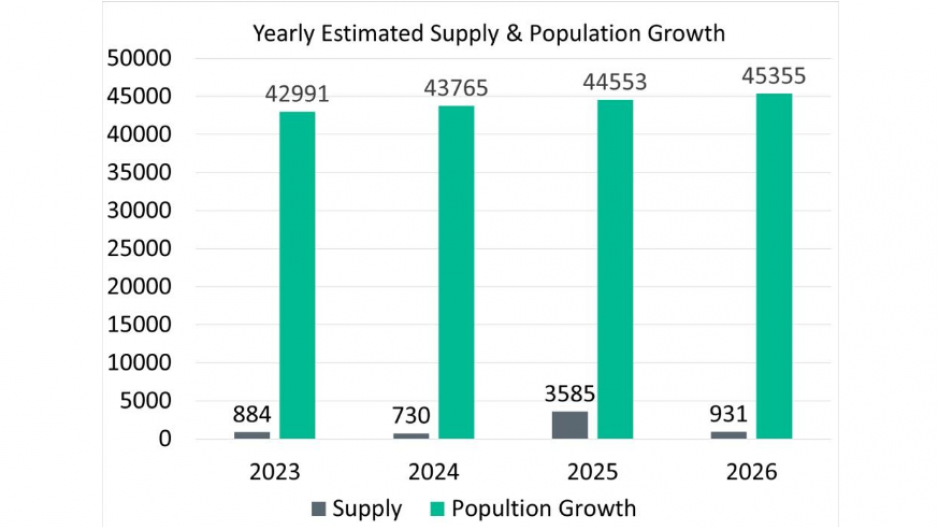

According to a CMHC report on how to increase affordability by 2030, the private sector will be “critical” in addressing the supply shortfall. This comes at a time when the federal government announced that Canada had set a new immigration record with 431,645 new permanent residents in 2022, according to a press release from Immigration Minister Sean Fraser.

“I'm fairly worried about what rents are going to do over the next few years with the level of immigration that we're going to see, in addition to a slowdown in construction across the board as a result of high cost and high interest rates,” he said.

According to Jones, rental rates have increased 17 per cent in Vancouver since mid-2022.

Hani Lammam, executive vice-president at Cressey Development Group, cites uncertainty in zoning and government financing as the main roadblocks for purpose-built rentals.

“When you have developers competing as to who can provide more sustainability and accessibility or more affordability, it just becomes treated as a level of uncertainty,” Lammam said. “Without certainty that we can get the financing, why would we go through a three or four year rezoning approvals process, only to get turned down because they didn't like the benefits package that we put forward?”

Going forward, Lammam believes that municipalities should look to pre-approve zoning for land meant for purpose-built rentals in order to cut back on the red tape needed to get approvals.

Both Lammam and Jones said they want to see changes made to the RCFi in order to provide funding with as few barriers as possible.

Shawn Bouchard, vice-president of Quadra Homes, submitted a report to the federal government June 2022 that looks to tweak the RCFi. With this program, the funds are borrowed by the developer in the form of a mortgage directly from the Bank of Canada (BOC). However, due to increased demand on the program, projects are not being funded and annual allocation is too low.

Bouchard is proposing an increase in funding and the creation of a fixed low interest rate direct from the BOC. According to the report, the only cost to the government would be administrative. In addition, significantly increasing the program does not impact federal expenditures or budget, according Bouchard.

“That way, they can provide a low interest rate and it doesn't cost anything to the taxpayer, it doesn't cost anything to the government. The government actually gets all that money back and the interest rate that they charge actually becomes a revenue stream,” he said.