The U.S. and Qatar will supply the bulk of additional LNG volumes to global markets in the near-term, but Canada, as a new player, appears well positioned in terms of supplying longer-term markets in Asia.

It is also well-positioned on the ESG front, as LNG projects in British Columbia are being designed with lower carbon intensities in mind.

Those are some of the observations in a new LNG brief by Evaluate Energy, which follows last week’s release of the International Energy Agency’s (IEA) recent World Energy Outlook. Both reports point to a mid-term increase in LNG demand, followed by longer term uncertainty, as advanced economies move to decarbonize.

“The U.S. and Qatar will meet most LNG demand to 2030,” the report forecasts. “Further out, there are opportunities for future supply growth.”

While the demand for LNG exports, mainly to Europe, have soared over the last couple of years, due in no small part to an energy crisis exacerbated by Russia’s war in Ukraine, it’s expected that the demand for LNG will eventually plateau in industrialized countries as they decarbonize.

Although the war in Ukraine spiked demand and prices for natural gas and LNG, and underscored concerns about energy security, it also has pushed Europe to accelerate its efforts to decarbonize.

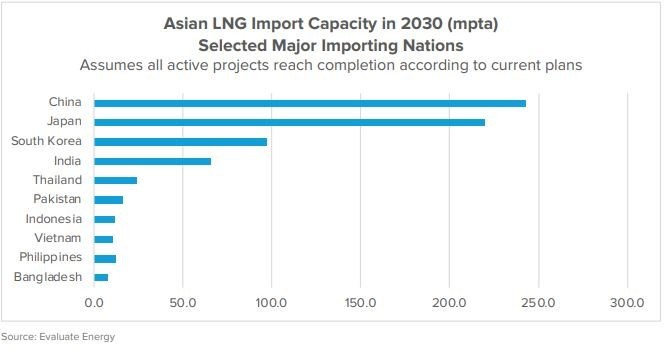

Europe is largely driving the short- and mid-term demand for LNG. By 2025, B.C. will start shipping LNG exports to Asia – the only region where longer-term demand is expected to continue to grow.

“What happens in Asia will decide the future course of the LNG industry for the next generation,” the Evaluate Energy report says.

“If the EU is successful in its decarbonization goals, demand will fall off,” the report forecasts.

“The future growth market for LNG is Asia. As Europe looks to cut its gas demand, Asia-Pacific gas demand will grow by at least 50 per cent by 2040.”

Trade in pipeline gas in Europe has fallen, resulting in increased trade in LNG, due to the war in Ukraine and the loss of Russian natural gas. But other emerging economies are also increasing their use of natural gas, including for generating power.

“The global LNG trade network is expanding, and now connects 20 exporting markets with 48 importing markets, including, in 2022, first-time LNG importers Germany, the Philippines and Vietnam,” the Evaluate Energy report observes.

It notes that regasification capacity has doubled in the last decade. (When natural gas arrives at a destination in liquid form, it needs to be turned back into a gas.)

“Global LNG import capacity is set to expand by 16 per cent… by the end of 2024 compared with 2022,” the report forecasts. “Market expansion will continue for the remainder of the decade. Cyprus is expected to start importing LNG in 2024, and Germany will have three more import terminals online by the end of 2023.”

The Asia-Pacific region is also increasing its regasification capacity, and it’s this region where the longer-term growth in demand is expected to be. Vietnam, for example, has announced the construction of five LNG importing terminals and more than 10 LNG-fueled power plants.

If all five new LNG projects or expansions currently in development in B.C. go forward, British Columbia will be exporting 6.8 billion cubic feet per day (bcf/d) of LNG, the Evaluate Energy report estimates. (Those projects are LNG Canada, Ksi Lisims, Cedar LNG, Woodfibre LNG and Tilbury Island expansion).

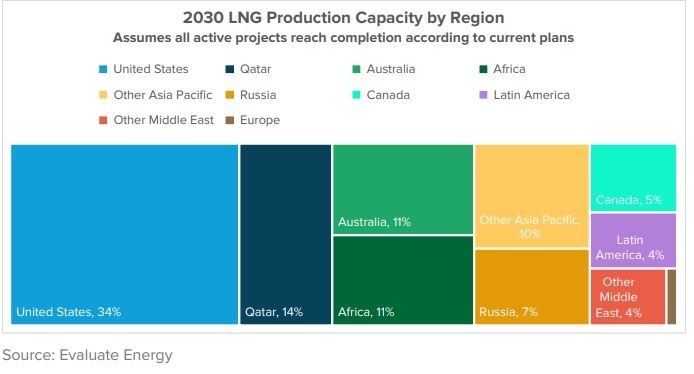

By 2030, Canada could be supplying five per cent of global LNG, which is slightly higher than the natural gas-rich Middle East.

The U.S. will be the biggest supplier by 2030, supplying 34 per cent of global LNG exports, followed by Qatar at 14 per cent, 11 per cent each for Australia and Africa, seven per cent for Russia, and four per cent each for the Middle East and Latin America.

“Longer term, successfully competing to supply the Asia-Pacific market will depend on price, reliability, and, ultimately, ESG performance,” the report warns.

Report touches on some of the geographic, climatic, cost and ESG advantages that Canadian LNG will have.

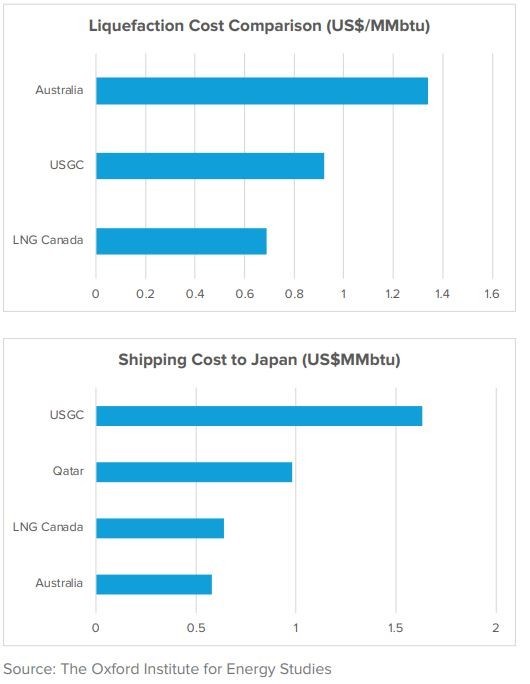

One disadvantage Canadian producers face is higher up-front construction costs and higher upstream transportation costs than the U.S. But its liquefaction costs are lower than the U.S., Australia and Qatar, due in part of its colder climate, and it has lower shipping costs to Japan than the U.S. and Qatar due to its proximity.

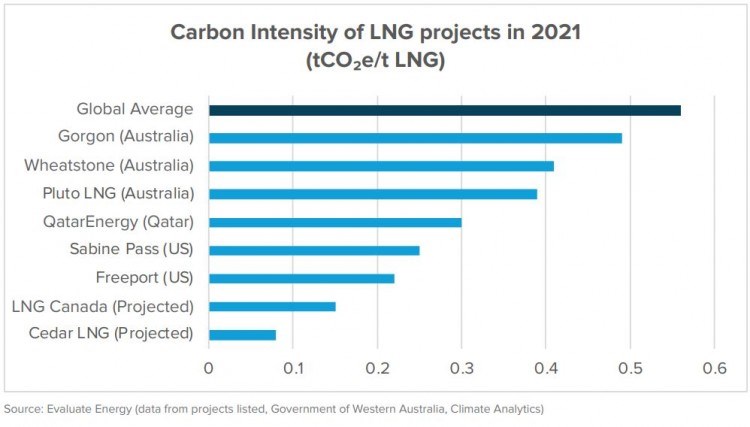

B.C. LNG projects will also have an ESG advantage, due to the fact that all of the projects being built in B.C. will have a comparatively lower carbon emissions intensity than all other competitors.

“As ESG requirements on downstream firms in the Asia-Pacific region grow, the carbon intensity of gas imports could become increasingly important,” the report notes.

Whereas the global average emissions intensity of LNG is 0.56 tonnes of CO2 equivalent per tonne of LNG (CO2e/t ), LNG Canada's emissions intensity will be 0.15 tonnes of CO2e/t LNG, the report notes. Other projects, like Cedar LNG, will have even lower emissions intensity: 0.08 tonnes of CO2e/t LNG.

“Canadian projects — with their cooler climate, shorter shipping distances, hydro-based electricity grid and upstream methane emissions reductions — are very well placed to compete,” the report concludes.