The U.S. Geological Survey (USGS) has told congressmen and senators that copper has not reached the status of critical minerals needed to be added to the official list of commodities at risk of undersupply, the Copper Development Association (CDA) said.

The USGS decision comes despite some high-ranking political allies throwing their support behind the local copper sector.

The copper marketing body says the metal’s supply risk score is now above the threshold for automatic inclusion on the 2022 Critical Minerals list. It adds the USGG quoted misleading arguments that were not part of its own official 2022 methodology, to justify its decision.

“Unlike in Europe, where copper was recently added to its proposed Critical Raw Material and Strategic Raw Material lists based on forecasting future supply and demand projections, USGS addresses supply risk with a rearward looking analysis,” the CDA said.

It noted the USGS did not address current and forward-looking policy demands that can leave domestic supply chains short of copper.

“Continued supply trends and solid data confirm that the supply risk for copper is not a short-term issue that will self-correct without determined, immediate, and strategic action,” CDA’s president and CEO Andrew G. Kireta said in the statement.

The USGS’s last official evaluation for the 2022 Critical Minerals List is based on copper trade data that represents supply risk from 2014 to 2018, five to nine years out-of-date, and too old to be meaningful, Kireta noted.

Early this year, Senator Kyrsten Sinema, an Independent from Arizona, sent a letter urging Interior Secretary Deb Haaland to “revisit and reconsider the designation of copper as a critical mineral.”

Supporters included other senators whose home states are hubs of copper production and manufacturing, including Mark Kelly of Arizona, Joe Manchin of West Virginia, Indiana’s Mike Braun, Raphael Warnock of Georgia and Mitt Romney of Utah.

“This should be a no-brainer,” Sinema said in an interview with Bloomberg in February. “We have major gaps in both our ability to mine and process these minerals to ensure our energy security for the future, and the administration knows how important copper is to our domestic and national security.”

CDA members include some of the biggest copper miner including Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO), BHP (NYSE: BHP; LSE: BHP; ASX: BHP), and Freeport-McMoRan (NYSE: FCX), as well as manufacturers such as Mueller Industries Inc.

The U.S. critical minerals list is updated every three years and includes key battery metals needed for electric vehicle production such as nickel, lithium and zinc.

Eight Escondida mines needed

Based on studies conducted by the world’s largest copper miner, Chile’s Codelco, the world’s energy transition to stop climate change will take demand for the metal from 25 million tonnes per year now to just over 31 million tonnes in 2032.

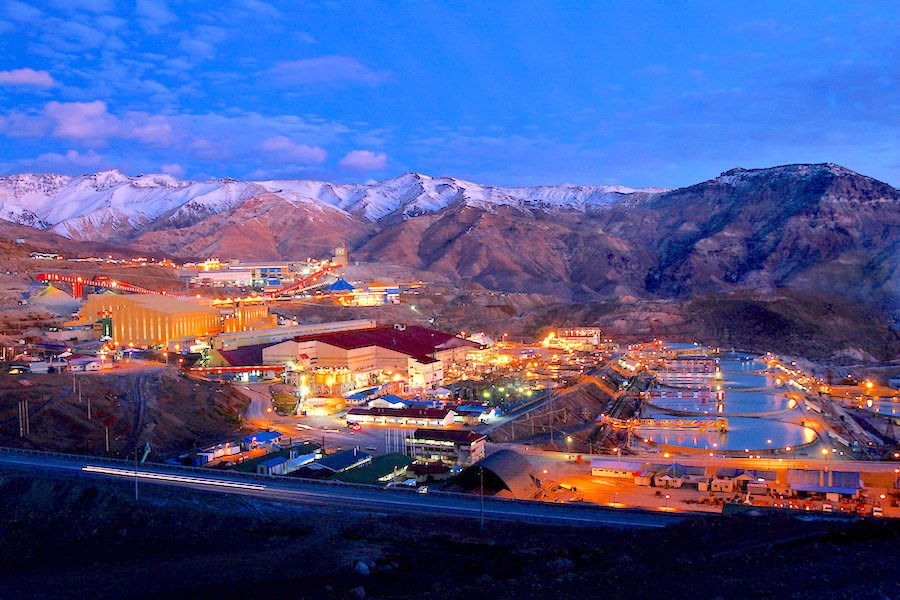

This means the world would need to build eight projects the size of BHP’s Escondida in Chile, the world’s largest copper mine, over the next eight years.

In terms of investment, experts estimate the industry needs more than US$100 billion to build mines able to close what could be an annual supply deficit of 4.7 million tonnes expected by 2030.