SAN FRANCISCO (AP) — Silicon Valley chipmaker Nvidia on Wednesday became the first publicly traded company to surpass a $4 trillion market valuation, putting the latest exclamation point on the investor frenzy surrounding an artificial intelligence boom powered by its industry-leading processors.

Although Nvidia's market value dipped back below $4 trillion by the time the stock market closed, reaching the milestone highlighted the upheaval being unleashed by an AI craze that's widely viewed as the biggest tectonic shift in technology since Apple co—founder Steve Jobs unveiled the first iPhone 18 years ago. Underscoring the changing of the guard, AI bellwether Nvidia is now worth $900 billion more than Apple, which rode the iPhone's success to become the first publicly traded company to valued at $1 trillion, $2 trillion and eventually, $3 trillion.

Nvidia's rise as come as Apple has struggled to deliver on its ambitions to infuse the iPhone and other products with more AI with an array of new features that included a more than year-old promise to smarten up its often bumbling virtual assistant Apple acknowledged last month that delivering on its AI vision is going to take until at least next year, leading some industry analysts to wonder if the company will have to acquire an AI start-up to regain momentum.

In the meantime, former Apple design guru Jony Ive has joined forces with OpenAI to work on a wearable AI device that could challenge the iPhone while Nvidia has been scrambling to meet the feverish demand for its specialized chips that power the energy-intensive data centers underlying artificial intelligence.

And tech giants Microsoft, Amazon, Google parent Alphabet and Facebook parent Meta Platforms are upping the AI ante too, collectively budgeting about $325 billion for investments in the technology this year — with a significant amount of that money likely to flow into Nvidia's coffers.

The ravenous appetite for Nvidia's chips are the main reason that the company's stock price increased by 10-fold since early 2023, catapulting its market value from about $400 billion to $4 trillion. After exceeding $4 trillion for the first time early Wednesday, Nvidia's shares backtracked below that threshold at their closing price of $162.88.

But most analysts don't expect the price to stay below $163 for long. In a sign of the pervasive optimism surrounding Nvidia, CFRA analyst Angelo Zino on Wednesday issued a research note predicting the stock will climb to $196 within the next year to push the company's market value to $4.8 trillion.

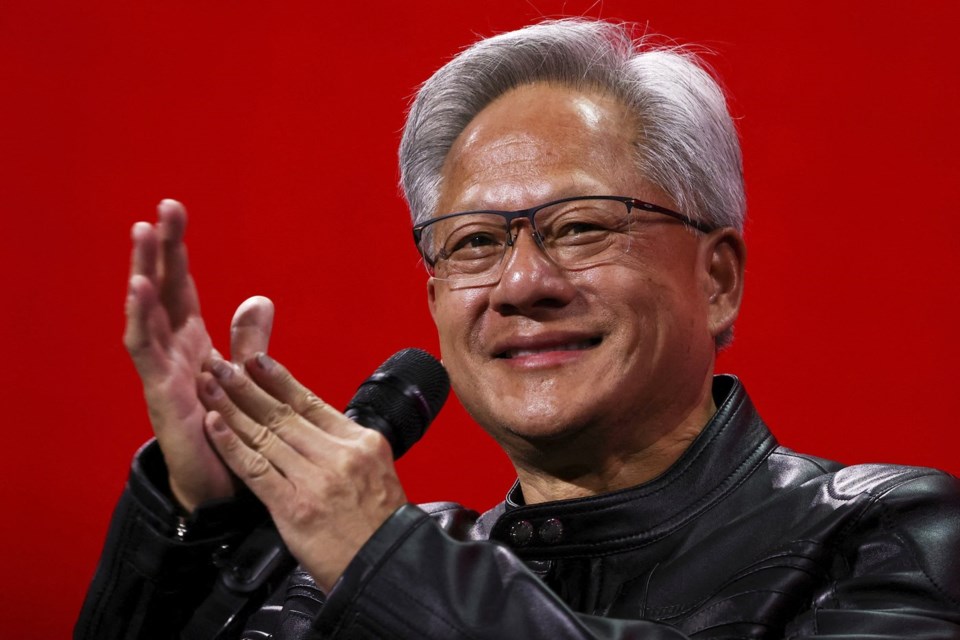

Nvidia's rapid rise also has anointed the company's founder and CEO Jensen Huang as “the godfather” of AI, whose dissertations about the technology's direction attract enraptured audiences. Huang's widening fame also has been accompanied by a fattening fortune, now estimated at $142 billion.

It looked like Nvidia may have hit a road block in early April when President Donald Trump unveiled sweeping tariffs and triggered widespread selloff in the stock market that hit the tech sector especially hard. At its nadir, Nvidia's stock price slipped below $87.

But Nvidia quickly bounced and in late May delivered another stellar quarter, highlighted by an $18.8 billion profit, despite a $4.5 billion hit to account for U.S. government restrictions on the sale of some of its chips to China.

The Santa Clara, California, company is scheduled to release its next quarterly report on Aug. 27.

.

Michael Liedtke, The Associated Press